Asset allocation formula

The Kelly formula for betting is introduced and applied for stock allocation. Half-Kelly allocation for stocks is proposed as a.

Solactive Diversification The Power Of Bonds

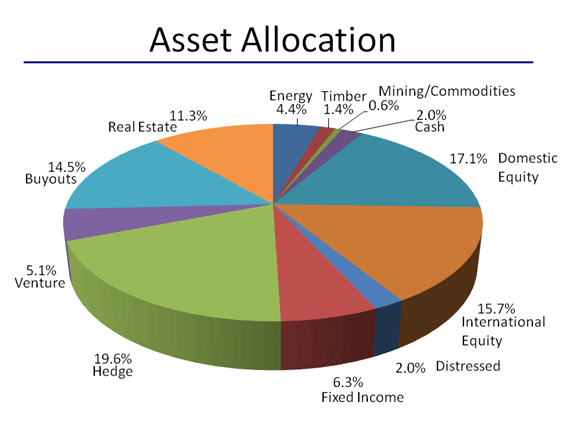

Asset allocation is an investment strategy that aims to balance risk and reward by apportioning a portfolios assets according to an individuals goals risk tolerance and investment horizon.

. The three main asset classesequities fixed-income and cash and equivalentshave different levels of risk and return so each w See more. This system is also called the Kelly strategy Kelly formula or Kelly bet. Ad Contact Us to Learn More About How Our Capital Allocation Services Can Help.

Asset allocation is very similar to gamble betting. Cover On Approach. Quality Asset Allocation Models For Investment Professionals.

Negative allocation effect indicates that the asset allocation decisions over the past 12 months whatever they were had a negative impact on the total portfolio performance. Asset allocation is a process. Performance attribution or investment performance attribution is a set of techniques that performance analysts use to explain why a portfolios performance differed from the.

Asset allocation aims to build a. Ad Learn How Vanguard Tools For Advisors Can Help You Forecast Client Portfolio Performance. The closing out of a profitable short position as the security moves toward a key level of support.

This article outlines how this system works and how investors use the formula to help in asset. This portfolio might have an allocation. Our Tools Provide Reliable Unbiased Data To Help You Analyze And Optimize Portfolios.

This is because the asset allocation in this type of portfolio is typically fairly well balanced between stocks and fixed income and cash. Using age minus 20 for bond allocation a starting age of 20 and a retirement age of 60 a one-size-fits-most. Delivering Better Decisions Accelerated Results - From Idea to Implementation.

Negative allocation effect indicates that the asset allocation decisions over the past 12 months whatever they were had a negative impact on the total portfolio performance. The asset allocation return is the result of deviations from the asset class portfolio weights of the benchmark. Age ability to tolerate risk and several other factors are used to calculate a desirable mix of.

As a security moves closer to a level of support. To put it in simple terms Asset allocation is the process of investing across diversified asset classes. 30 Lower Production Cost.

Ally Brings Smart Easy Affordable Robotics to a Shrinking Labor Force. Contract With 500M Company. The security selection return results from deviations from benchmark weights.

To make your allocation decisions easier financial professionals have devised some standard formulas for dividing up your portfolio based on. Ad Position Market Products Construct Portfolios And Analyze Mutual Fund Ratings. Lets look at some examples of asset allocation models by age.

Following asset allocation formula. Ad Fidelitys Comprehensive Method To Asset Allocation May Help Balance Risk. The Asset Allocation Calculator is designed to help create a balanced portfolio of investments.

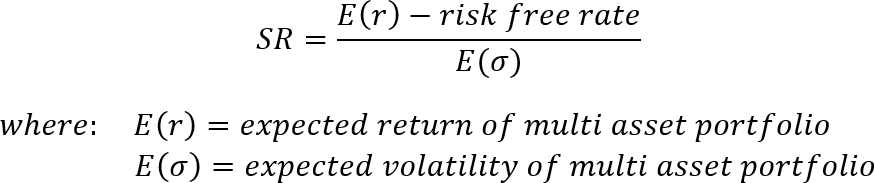

Asset allocation is the implementation of an investment strategy that attempts to balance risk versus reward by adjusting the percentage of each asset in an investment portfolio according. The Capital Allocation Line CAL is a line that graphically depicts the risk-and-reward profile of risky assets and can be used to find the optimal portfolio. The two key aspects of this definition are as follows.

Asset allocation determines the mix of assets held in a portfolio while security selection is the process of identifying individual securities. To make asset allocation work for you it is imperative that you consider your own specific circumstances to arrive at a customised asset allocation strategy. Start Your Demo Today.

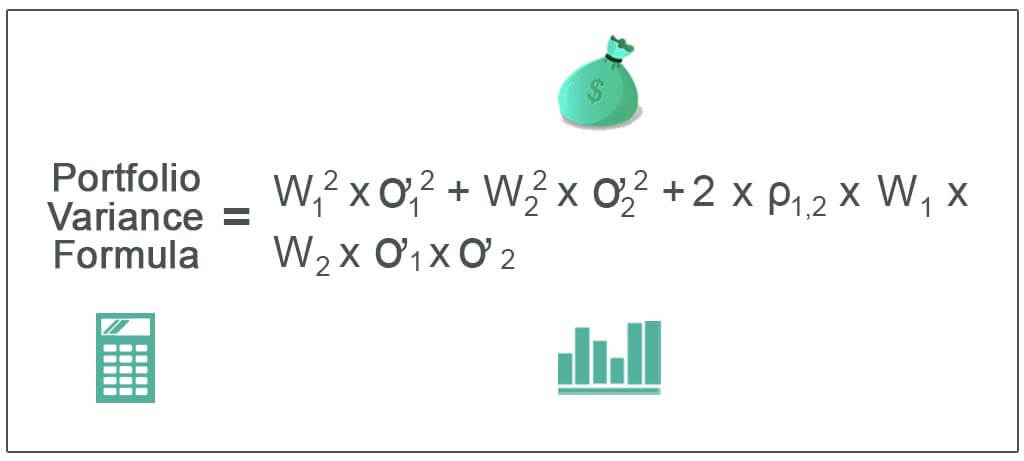

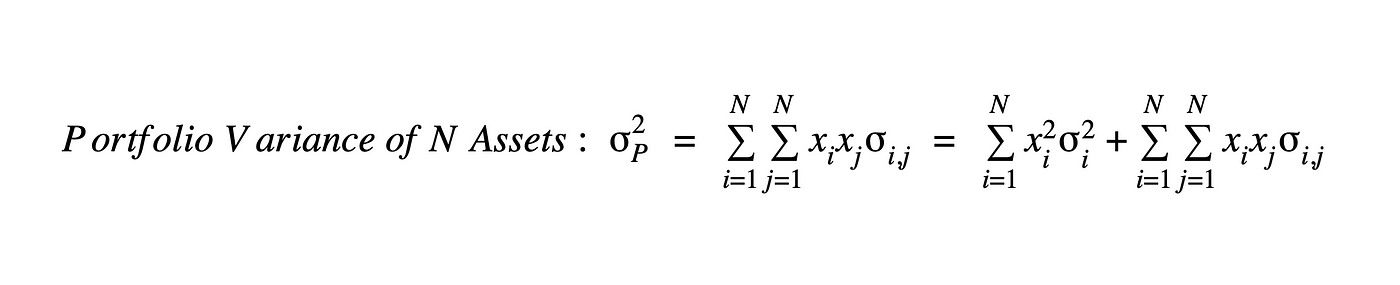

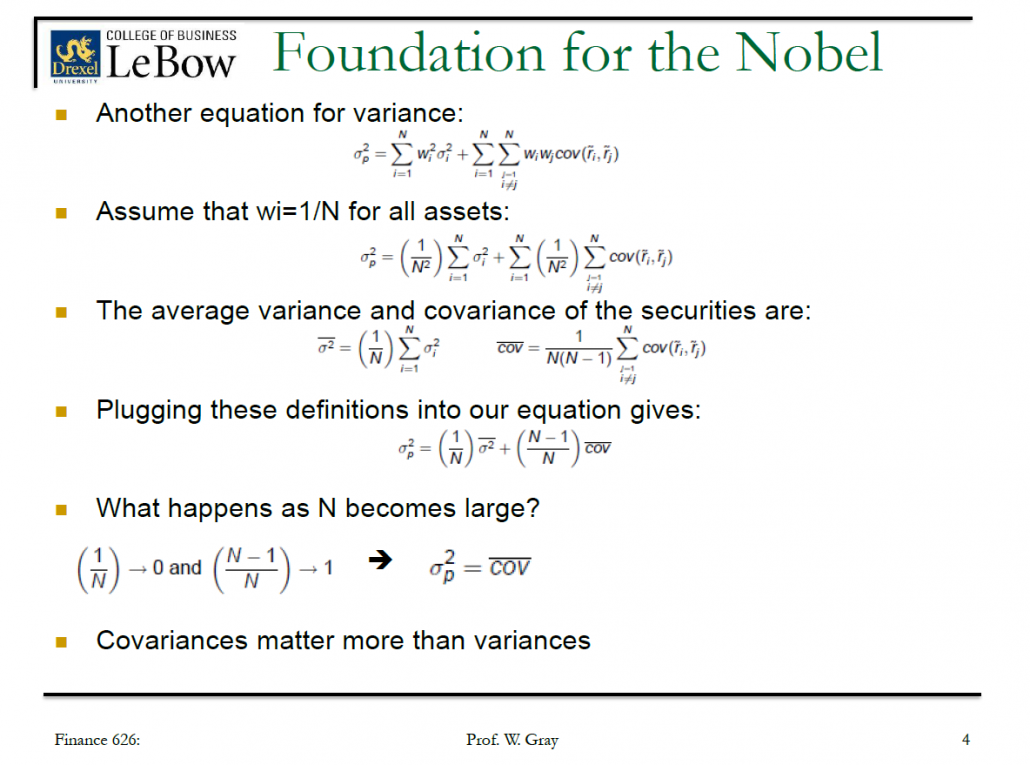

Portfolio Variance Formula Example How To Calculate Portfolio Variance

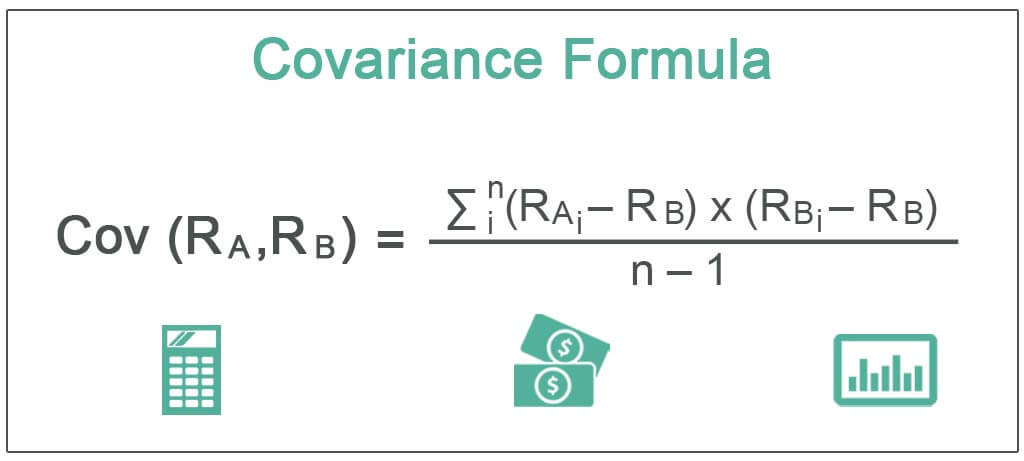

Covariance Meaning Formula How To Calculate

Mean Variance Portfolio Optimization Using Python By Lumos Student Data Consulting Medium

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Standard Deviation And Variance Of A Portfolio Finance Train

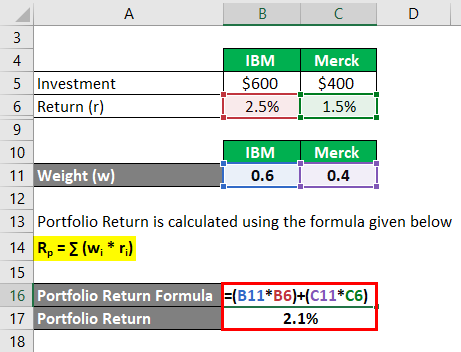

Portfolio Return Formula Calculator Examples With Excel Template

Tactical Asset Allocation Beware Of Geeks Bearing Formulas

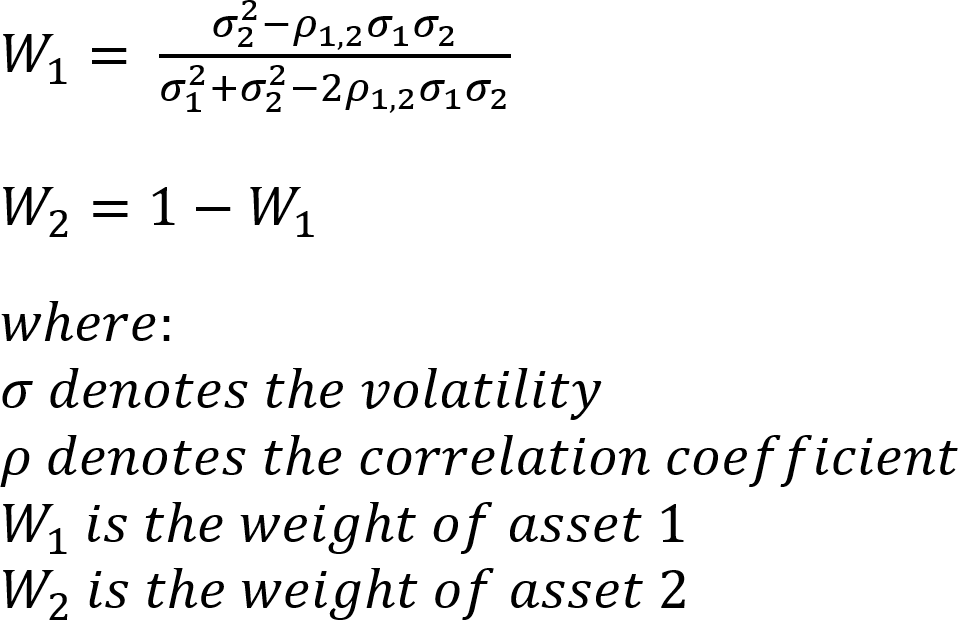

Optimization Formula For Optimal Portfolio Of 2 Assets When No Shorting Allowed Quantitative Finance Stack Exchange

Capital Allocation Line With Two Assets Formula Calculation Graph

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Solactive Diversification The Power Of Bonds

Lower Risk By Rethinking Asset Allocation Seeking Alpha

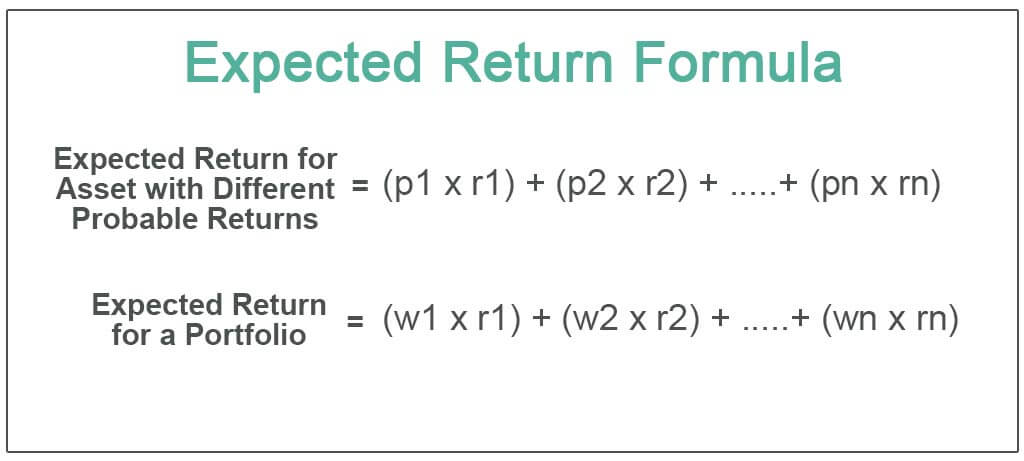

Expected Return Formula Calculate Portfolio Expected Return Example

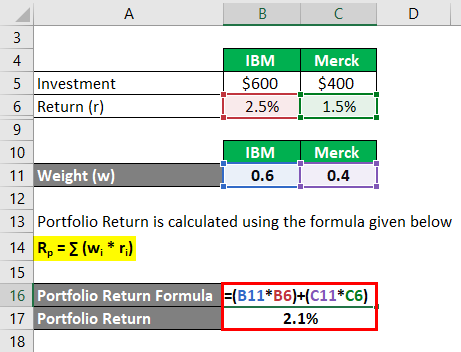

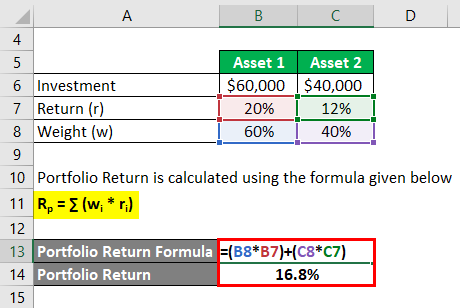

Portfolio Return Formula Calculator Examples With Excel Template

Portfolio Return Formula Calculator Examples With Excel Template

/the-5-percent-rule-of-investment-allocation-2466542_FINAL-f143cd6bc6a64b22a80f75a610da985e.gif)

Learn The 5 Rule Of Investing

Asset Management Lecture 15 Outline For Today Performance Attribution Ppt Download

Komentar

Posting Komentar